Investment

The Motley Fool

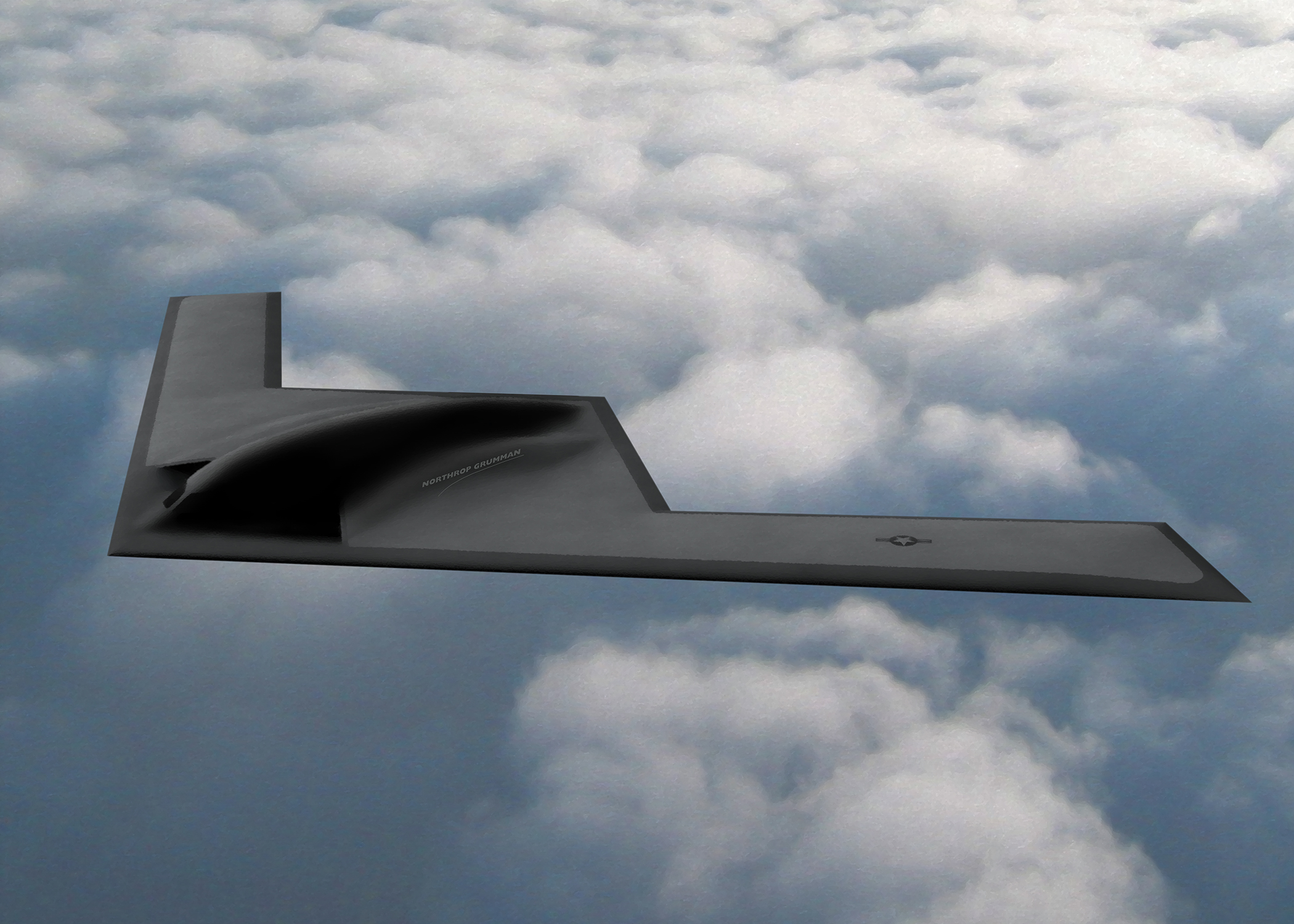

Why Northrop Grumman Stock Is Up Today

Why This Matters

The analysis indicates that Northrop Grumman (NOC 9. 29%) posted better-than-expected quarterly results and raised full-year guidance. Investors were pleased, sending Northrop s up 8% as of 1 p (fascinating...

July 22, 2025

01:44 PM

3 min read

AI Enhanced

Positive

FinancialBooklet Analysis

AI-powered insights based on this specific article

Key Insights

- Earnings performance can signal broader sector health and future investment opportunities

- Financial sector news can impact lending conditions and capital availability for businesses

Questions to Consider

- Could this earnings performance indicate broader sector trends or company-specific factors?

- Could this financial sector news affect lending conditions and capital availability?

Stay Ahead of the Market

Get weekly insights into market shifts, investment opportunities, and financial analysis delivered to your inbox.

No spam, unsubscribe anytime